Answer:

They should deposit $45,467.95 now.

Step-by-step explanation:

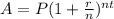

The formula for calculating the future value of compound interest can be written as;

Where;

A = Future amount

P = Principal (initial amount)

r = Interest rate (decimal)

n = number of times the interest is compounded per unit time "t"

t = time

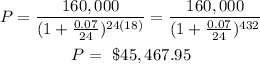

Making the Principal (P) the subject of formula in the formula above we have;

Given;

A = Future amount = $160,000

r = Interest rate (decimal) = 7% = 0.07

n = number of times the interest is compounded per unit time "t" = 2(12) = 24 times per year

(Twice in a month times 12 months in a year.)

t = 18 years

substituting the given values into the formula above, we have;

Therefore, They should deposit $45,467.95 now.