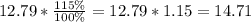

a. The total cost of the purchase is $12.79 and it is subject to GST and PST taxes.

Let's find 115% of the purchase, so:

The total cost including taxes is $14.71

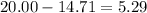

The change from $20 would be:

b. Finding the 115% of the price gives the total cost including taxes, because there we have 100% that is the cost of the purchase plus 15% that represents the taxes. Then, if we add 100+15 we obtain 115%, and by multiplying the cost before taxes by this, we have found the total cost including taxes.

c. If only PST is applied, to determine the total cost in one step, we need to add 100% plus 8% of PST, so we need to use 108% to find the total cost.

d. If only GST is applied, we need to add 100% plus 7% of GST, then we have to use 107% to determine the total cost in one step if only GST is applied.