Solution:

Given that Stephen purchased a home for $149,000, and a mortgage company approved his loan application for a 30-year fixed rate at 5%.

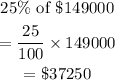

If he pays a 25% down payment, this implies that the amount he paid as a down payment is evaluated as

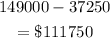

Thus, the amount to be financed is evaluated as

![undefined]()