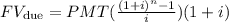

We are asked to determine the future value for an annuity that is paid at the beginning of every six months with an interest rate of 4.62% compounded semi-annually (every six months). To do that we will use the following formula:

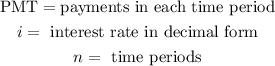

Where:

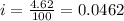

The PMT is the $40 payments every six months and the interest rate "i" in decimal form is:

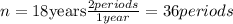

And the time period "n" is the number of six months in a year, since every year there are two periods of six months, in 18 years we have:

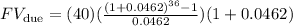

Replacing the values we get:

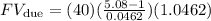

Now we solve the operations:

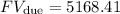

Solving the operations we get:

Therefore, the accumulated value is $5168.41