The given information is:

- The function that represents the sales price at the superstore is:

- The function that represents the HST owed on a purchase with a selling price of x dollars is:

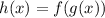

a. The function that represents the HST owed on an item with a price tag of x dollars after it has been beaten by 10% is given by the composite function:

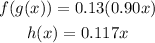

So, we replace the x in the f(x) function with the g(x) value, as follows:

The equation is above.

b. How much HST would be charged on a $39.99 purchase if this price is also lowered by 10% first?

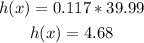

Then, by using the equation we found in part a, we replace x by 39.99 and solve:

$4.68 would be charged