A school district’s property tax rate rises from 2.5% to 2.7% to cover a $300,000 budget deficit (shortage of money).

What is the value of the property in the school district to the nearest dollar?

Let x represents the value of the property in the school district.

The increase in property tax rate is

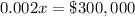

0.2% means 0.2/100 = 0.002 (in decimal)

So, we can write the following equation

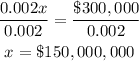

Let us solve the equation for x.

Therefore, the value of the property in the school district (to the nearest dollar) is

That is 150 million dollars.