The Solution:

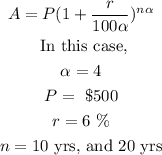

It is given that

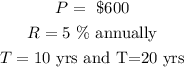

For Bank A:

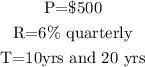

For Bank B:

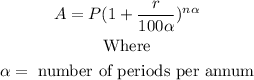

By the formula for the compound interest, we have

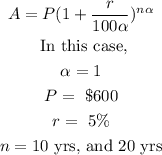

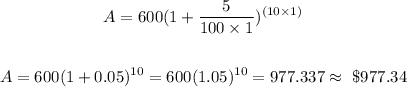

For Bank A:

Substituting the corresponding values, we have

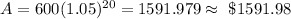

For Bank A for after 20 years:

Similarly, for Bank B:

Substituting these values in the formula, we get

![undefined]()