1. A lump sum is a one-time payment after a certain period of time, whereas an ordinary annuity involves equal installments in a series of payments over time. A business can use lump sum or ordinary annuity calculations for present value and future value calculations.

The present value of a lump sum is the value of the amount today

2. The present value of an annuity is the current value of future payments from an annuity, given a specified rate of return, or discount rate.

Annuity due is an annuity whose payment is due immediately at the beginning of each period.

3. The present value of a lump sum is defined as:

Where variables in the formula are explained as follows

PV = Present Value of the given amount today

FV = Future Value of the given amount

i = Discount rate

n = Number of periods

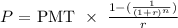

The Present value of an annuity is given as:

The variables in the equation are explained as the follows:

P = the present value of annuity

PMT = Payment per period or the amount in each annuity payment

r = the interest or discount rate

n = total number of periods or the number of payments left to receive