According to the problem, the principal is $800, that's the investment.

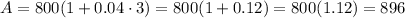

For the first case (a), we have a simple interest rate of 4% and a time of 3 years. Let's use the simple interest formula

Then, let's replace the given values

They will have $896.

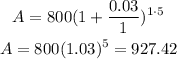

On the other hand, for the second case (b), the compound interest is 3% compounded annually for 5 years. Let's use the compound interest formula

Where P = 800, r = 0.03, n = 1, and t = 5.

Hence, they will have $927.42 if the interest compounds annually.