His pension is given as 1.45% of his average salary for the last five years worked.

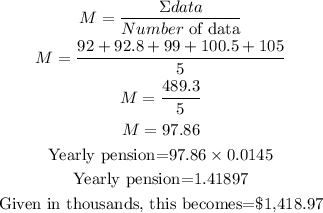

The average for the last five years is calculated as follows;

Therefore his yearly pension which is 1.45% of his average salary for the last 5 years ($97,860) is $1,418.97