.Explanation.

To determine the best account to choose, we will have to check for the amount each account will yield

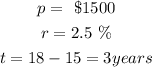

For the first account, with 2.5% simple interest annually

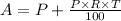

To find how much this account will yield at 2.5% simple interest annually, we will use the formula

Where

Thus, the first account will yield

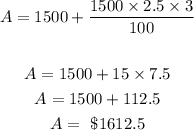

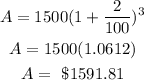

For the second account with 2% interest compounded annually

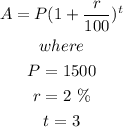

Thus the account will yield

We can see that the first account with 2.5% simple interest annually yields $1612.50 and

The second account with 2% interest compounded annually yields $1591.81

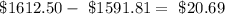

The difference in the accounts will be

Thus, I will choose the first account with 2.5% simple interest annually, because it yields $20.69 more than the second account after 3 years