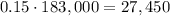

First, let's find 15% of 183,000.

The down payment is $27,450.

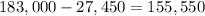

(a) To find the amount of the loan, we just have to subtract.

Hence, the loan amount is $155,550.

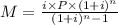

(b) The monthly payment formula is

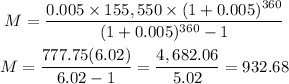

Where P = 155,550. i = 0.06/12. n = 360 (number of payments). Let's replace these values.

Hence, the monthly payment is $932.68.

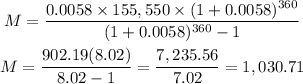

(c) We repeat the process but instead of using 6% interest, we are going to use 7% interest.

P = 155,550.

i = 0.07/12.

n = 360.

Then, we replace the values in the formula.

Hence, the monthly payment is $1,030.71 with 7% interest.