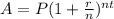

In order to calculate the balance in compound interest, we can use the formula below:

Where A is the balance after t years, P is the principal (initial amount), r is the interest rate and n is how many times the interest is compounded in a year.

For continuous compounding, we use this formula instead:

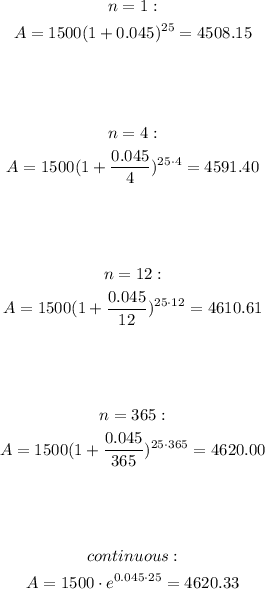

So we have: