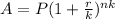

(A) Given that:

Present value, P = $7000

Annual percentage rate, r = 5.2% = 0.052

Number of compounding periods, k = 2

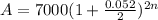

(B) Plug the values into the formula

gives

Substitute 8 for n to find the amount of money after 8 years.

In 8 years, Dylan will have $10554.94 in account.

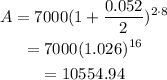

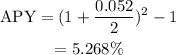

(C) Find the annual percentage yield using the formula

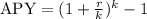

Plug the values into the formula.

The annual percentage yield for the savings account is 5.268%.