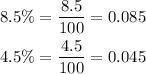

First, we convert the percentages to decimal by dividing by 100.

The total tax Brad will pay can be found by summing the state sales tax and the city sales tax.

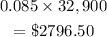

State Sales Tax >>>

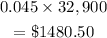

City Sales Tax >>>

The total amount of tax is

2796.50 + 1480.50 = $4277