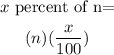

We are given that Heather made $25000 and she must pay 15% if this amount in income tax. Let's remember how to calculate the "x%" percentage of a given quantity "n":

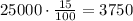

Applying this formula we get:

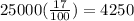

We are also told that she must pay additionally 17% because the amount is greater than $7000, therefore, we calculate the 17% of 25000 using the previous formula:

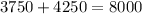

Now we add both results to get the total amount she must pay:

Therefore, Heather must pay $8000 in income tax.