Answer:

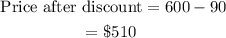

The price of the sofa after a 15% discount is $510.

Explanation:

Given:

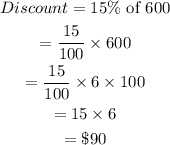

• The cost of the sofa = $600

,

• Discount = 15%

We want to find the price of the sofa after a 15% discount.

First, determine the discount amount.

Next, subtract the discount from the cost of the sofa.

The price of the sofa after a 15% discount is $510.