Given

Tax rate = 28.5 mills

Smith's house is accessed at $80,000

Jones's house is accessed at $67,000

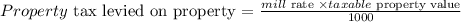

Property taxes are calculated by multiplying the assessed, taxable property value by the mill rate and then dividing that sum by 1,000.

The formula is given by:

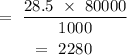

Property tax for the Smith's:

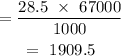

Property tax for the Jones':

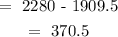

The extra amount the Smith's pay is the difference in the tax levied on Smith and Jones:

Hence, the Smith's pay $370.5 more than the Jones'