To determine the rate, substitute the given values into the following equation:

where I is the amount of the interest, P is the principal amount, r is the rate, and t is the time in years.

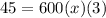

Thus, we have:

Simplify the right side of the equation. Multiply 600 and 3.

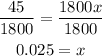

Divide both sides of the equation by 1800.

Therefore, the rate is 0.025 or 2.5%.