Solution:

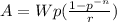

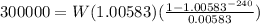

We can use the following formula:

Here A is the initial amount at the account;

W is the monthly withdrawn value;

r is the nominal monthly percentage.

n is the number of withdrawing periods (months, in this case).

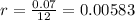

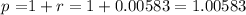

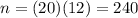

Now, in this case, we have the following data:

and the number of payment periods (= the number of months) is

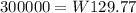

Applying these data to the formula given at the beginning of this explanation, we obtain:

this is equivalent to:

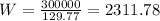

solving for W, we get:

Thus, the correct solution is:

You will be able to withdraw about $2311.78 every month for 20 years.