We have two options for the investment: Bank One and Bank Two.

The capital to invest is $500 (PV=500).

At Bank One, she can invest it at an annual rate of 2.3% (r=2.3/100=0.023), compounded annually.

At Bank Two, the interest rate is 2% (r=0.02) and the interest is not compounded.

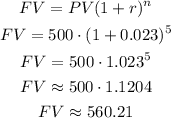

Then, for an investment of 5 years, at Bank One she will have a future value FV of her investment of:

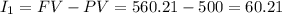

We can calculate the interest earned in those 5 years as teh difference between the final value and the present value:

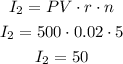

Now, for Bank 2 we can calculate the interest as:

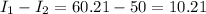

Then, we can calculate how much more she will earn in Bank One as the difference between I1 and I2:

Answer: she will earn $10.21 more in Bank One than in Bank Two.