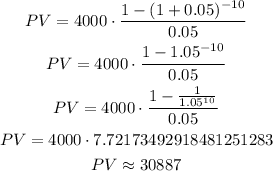

We have a deposit of $4000 at the end of each year.

The rate is 5% compounded annually (r = 0.05).

The number of periods is n = 10.

We have to calculate the present value of the annuity.

We will use the formula:

If we replace with our data, we get:

Now, we have to calculate the interest.