Remember that

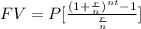

The formula for the future value of an ordinary annuity is equal to:

where

FV is the future value

P is the periodic payment

r is the interest rate in decimal form

n is the number of times the interest is compounded per year

t is the number of years

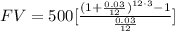

In this problem we have

P=$500

r=3%=0.03

t=3 years

n=12

substitute in the formula

FV=$18,810.28