Answer:

Given that,

A house with an assessed value of $480,000 has a property tax of $5,760.

To determine the property tax on a house with an assessed value of $600,000 (assuming the same tax rate),

Since the assessed value increases, property tax is also increase, it is direct variation.

Let x be the property tax on a house with an assessed value of $600,000,

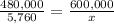

Using the definition of direct variation we get,

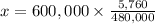

Solving for x,

We get,

The property tax on a house with an assessed value of $600,000 is 7200 dollars.

Answer is: $7200.