The rule of the interest compounded continuously is

A is the new amount

P is the initial amount

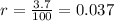

r is the rate of interest in decimal

t is the time

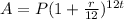

The rule of the compounded monthly interest is

A is the new amount

P is the initial amount

r is the interest rate in decimal

t is the time

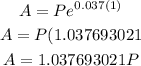

Since the account pays 3.7% interest compounded continuously, then

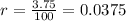

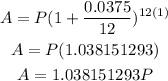

Since the other account pays 3.75% compounded monthly, then

Since the value of A of the 2nd account is greater than the value of A in the 1st account, then

The better is the 2nd account