The Solution.

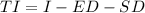

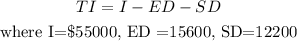

The given formula for taxable income is

In this case,

T I = taxable income, I = income, ED = exemption deduction, SD = standard deduction.

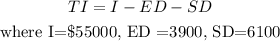

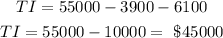

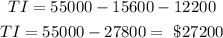

a. The taxable income of a single person with no kids, and has an income of $55,000.

Substituting these values in the formula, we have

b. The taxable income of a couple with two children, and with a combined income of $55,000.

Substituting these values in the formula, we have

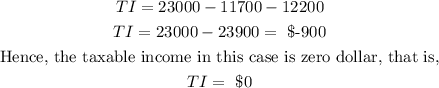

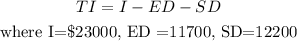

c. The taxable income of a couple with two children, and with a combined income of $23,000.

Substituting these values in the formula, we have