Let us calculate the monthly mortgage payment and the total payment for each condition given.

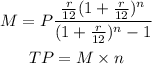

Please note that the formula for calculating monthly mortgage payment and Total payment is as shown below:

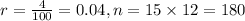

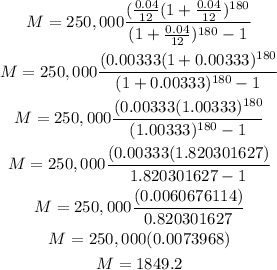

When the rate is 4% for 15 years, M and P is calculated as shown below:

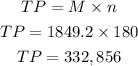

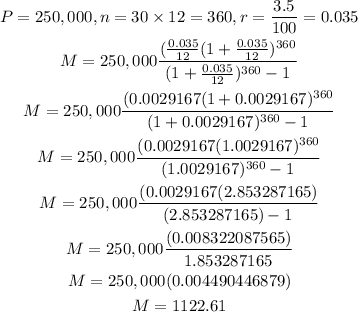

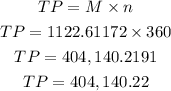

When the rate is 3.5% for 30 years, M and P is calculated as shown below:

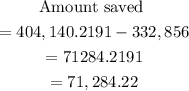

The amount that could be saved is subtracting the less total payment from the higher as shown below:

Hence, the amount would be saved is $71,284.22