Step-by-step explanation:

Given;

We are told that a promissory note of $800 is issued at the rate of 8% ordinary interest and a 180-day term.

Required;

We are required to determine the total payment required to pay off the promissory note.

Step-by-step solution;

For a repayment on a promissory note the interest payable will be calculated by the simple interest method.

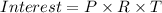

That is;

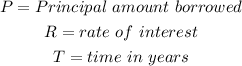

Here, the variables are;

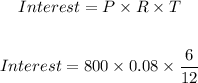

For a 180-day term, the time in years will now be the total number of months divided by 12. This is because the term is not up to a year, and therefore the time will be prorated as a ratio of a complete year (12 months).

Note here that the 180-day term is the equivalent of 6 months (considering 30 days in a month).

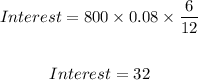

We can now complete the computation of the interest;

The total repayment will now be the principal amount borrowed plus the interest calculated.

Hence, we have

ANSWER:

Option A: $832.00