The FICA tax paid is split as follows;

All paid out of the employees gross wages.

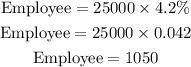

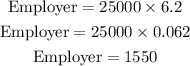

For an employee who earns a total gross wage of $25,000, the tax payment would be calculated as follows;

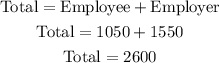

Total tax payment;

ANSWER:

The total amount paid for someone who earns $25,000 a year would be $2,600.