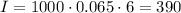

In order to calculate the interest for plan Y, let's use the simple interest formula:

Where I is the interest, P is the principle (initial investment), i is the interest rate and t is the amount of time.

Using P = 1000, i = 0.065 and t = 6, we have:

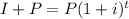

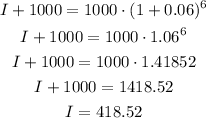

Now, for plan Z, we use the compound interest formula:

Using now i = 0.06:

So plan Z offer better returns in these conditions.