Since Dawn earns $13 per hour and she works 40 hours each week she earns a total of:

$520 per week. Now that we know that we conclude that she earns $1040 biweekly.

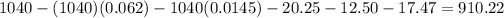

From this we have to substract the deductions, then she earns:

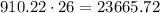

$910.22 biweekly. Now, we know that a year has 52 weeks; we need to divide this by 2 to get the total times she earns the biweekly salary, then we get 26 biweekly payments. Therefore she earns:

therefore she earns $23,665.72 annually