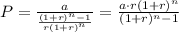

This problem seems to be about simple interest rates, which is defined by the formula

Where P refers to the payment per month, r refers to the interest rate (divided by the number of months per year), t is time in years, n is the number of periods per year.

This formula is about amortized loan payments.

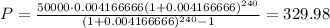

According to the problem, the final amount is unknown, the principal is $50,000.00, the interest rate is 0.05 (5%) and the time is 20 years. So, we need to substitute each value in the formula to find the amount we'll pay after the interest

This means we are gonna pay back $329.76 per month.

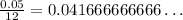

It's important to consider that the rate r is found by dividing the interest 0.05 and the total months per year which are 12

As you can observe, this is an infinite decimal number, so we take many decimal numbers as we need to get 329.98.