In this case, we'll have to carry out several steps to find the solution.

Step 01:

Data:

principal = $600

time (period) = 10 years

rate = 5.4% = 0.054

Step 02:

ordinary annuity:

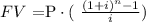

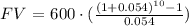

FV = future value of ordinary annuity

p = 600

n = 10

i = 0.054

FV = 600 * 12.8152 = 7689.1378

The answer is:

FV = 7689.14