Answer: $71942.45

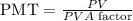

We can solve this problem by using the following formula:

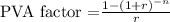

To solve for the PVA factor, we will use the formula,

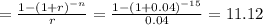

From the given problem, we know that:

r = 4% = 0.04

n = 15

Substituting this to our equation,

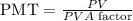

Now that we have our PVA factor, we can now solve for the PMT.

We now know that:

PV = $800000

PVA factor = 11.12

Substituting these to the equation:

Hence, the maximum annual withdrawal he can make over the following 15 years is $71942.45