Given -

Card A charges: 0% interest for the first year, and then 0.8% interest compounded continuously after that.

Card B charges: 0.7% compounded continuously.

Purchase Amount = $500

Payment Made after = 2.5 Years

To Find -

Which Card to choose and the final amount=?

Step-by-Step Explanation -

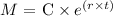

To find the total amount of interest compounded continuously we use the formula:

Where,

C = Initial Amount

r = Rate of Interest

t = Time

Now,

Since the total amount you have to pay for the purchase on credit card A is lower, it's the best option.

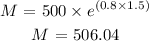

Putting Values in the formula for card A, we get:

Final Answer -

Option (c): Card A , $506.04