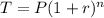

We can interpret this as a compounded interest. Remember that its formula is:

Where:

• T, is the total amount after the investment. In this case, after the raise

,

• P, is the principal. In this case, the intial salary

,

• r, is the interest rate. In this case, the raise percentage

,

• n, is the times the interest is compounded. In this case, the times the raise is compounded.

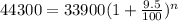

Using this and the data given, we'll have the following equations:

Solving for n,

![undefined]()