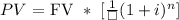

For solving this exercise, we will use the formula of the Present or Current value, as follows:

Where:

PV = Present or Current Value

FV = Future Value

i = Interest or discount rate

n = Periods of time

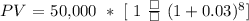

Replacing with the values we know:

PV = 50,000 * 0.7894

PV = 39,470

Bob's Mom