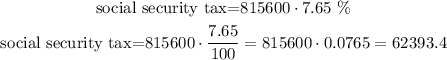

To determine the amount of social security tax was paid we need to calculate how much is 7.65% of $815,600. For that we will convert the percentage to a fraction and multiply it by the total amount of gross wages. This is done below:

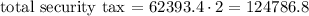

Since the tax was paid by the employees and employer we need to multiply it by 2.

The total amount paid was $124786.80.