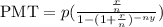

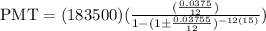

We have that the PMT formula is given by:

Where p is the initial principal (Loan ammount), r is the interest rate period, n is the total number of payments or periods, y is the number of years, PMT is the monthly payment.

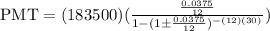

Now, replacing the data in the formula, we will get:

*The payment will be due for 30 years, that is 12 months each year [That is our n] and y will be 30, r is 0.0375.

p will be $183500, that is:

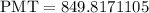

Then, we will have that the monthly payment for the 30 years, should be:

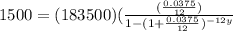

If she wishes to pay $1500 each mothn, we then replace in the formula:

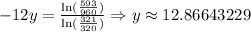

Now, solving for Y, we will have:

From this, we have that if they pay a monthly morgage of 1500, they would take 13 years to pay the total cost.

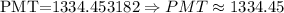

If they wanted to pay the morgage in 15 years, then we replace in the formula as follows:

That is:

They would have to pay $1334.45 each month in order to pay the morgage in 15 years.