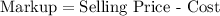

When you sell an item, you don’t charge the same amount you paid for it. You mark it up to make a profit. Markup is the difference between how much you spent on an item vs. how much more you’re selling it for. The greater the markup, the more you keep as profit once you sell the products. Wholesale businesses and retailers use markup to set product prices. Markup is expressed as a percentage.

Many business owners can’t help but think about margin when talking about markup. You can use both markup and margin to determine prices and measure a product’s profitability. Like markup, margin is expressed as a percentage.

Again, markup shows the difference between selling price and product cost. On the other hand, margin shows the percentage of revenue you earn per product.

You need to know how to calculate markup if you want to do strategic pricing. Strategic pricing helps you to set an attractive price to maximize your profit

For your first reply post:

To come up with a markup percentage, use the markup formula … which we’ll get into soon. But before you can calculate markup, you need to know a few basic accounting terms:

Revenue: Income you earn by selling products.

Cost of Goods Sold (COGS): Expenses that go into making your products (e.g., materials and direct labor costs).

Gross Profit: The difference between revenue and COGS.

For your second reply post:

The mark up for the prices of goods sold goes up / down :

here are many factors a business owner should consider when pricing a product using markup and breakeven analysis. These three may be the most important:

.The cost of production

.The market demand for the product

.The desired markup by the business owner