Hello! We can solve this exercise using the formula to calculate compound interest:

Let's suppose P = 100, so A must be approximate 200 (double).

t = 7 years

r = unknown rate

e = mathematical constant

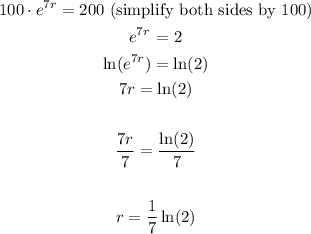

Now, let's solve it:

Using a calculator, we have ln(2) = 0.69314718056, so we have to divide it by 7, obtaining r = 0.099.

So, the interest rate must be equal to 0.10.