The sales tax formula is used to determine how much businesses need to charge customers based on taxes in their area. State and local governments across the United States use a sales tax to pay for things like roads, healthcare and other government services. Sales tax applies to most consumer product purchases and exists in most states.

The sales tax formula is simply the sales tax percentage multiplied by the price of the item. It's important for businesses to know how to use the sales tax formula so that they can charge their customers the proper amount to cover the tax. For consumers, it's good to know how the sales tax formula works so that you can properly budget for your purchases

The sales tax formula is as shown below:

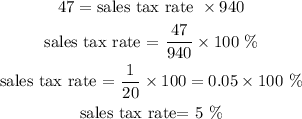

Given that

Sales tax = 47

price of the dining room = 940

Sales tax rate= unknown

To find the sales tax rate, we would substitute into the formula above

Hence, the sales tax rate is 5%