We will have the following:

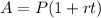

First, we recall that the simple interest formula is given by:

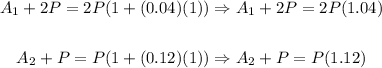

Now, for the accounts that are described in the problem we will have that:

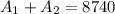

Now, we have that:

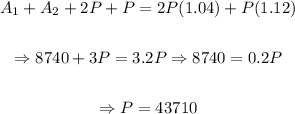

Then:

So, the amount invested at 4% interest is $87 420.

And, the amount invested at 12% interest is $43 710.