Recall that:

Therefore Daisy pays:

in taxes for the videogame.

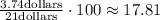

Now, recall that to determine the percentage that a represents from b we use the following expression:

Therefore, the sales tax applied to the videogame is:

percent.

Answer: The tax applied to the videogame is 17.81%, in this case, the sales tax is 3.74 dollars.