Percentages

A

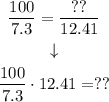

We know that the tax rate is 7.3% and it corresponds to $12.41. We want to find the total price of the table saw without taxes, it is to say the 100%. We have the following equivalence:

100% ⇔ ??

7.3% ⇔ $12.41

If we divide both parts of the equivalence we will have the same result:

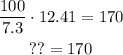

Multiplying both parts of the equation by 12.41:

Now, we can find the total price of the table saw without taxes:

Answer A. the purchase price is 170

B

The total price of the table saw (it is to say, including taxes, $12.41), is

170 + 12.41 = 182.41

Answer B. the total price is 182.41