Remember that

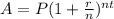

The compound interest formula is equal to

In the 3.99% compounded semiannually

we have

r=3.99%=0.0399

n=2

substitute

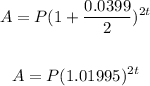

and

![\begin{gathered} A=P[(1.01995)^2]^t \\ A=P(1.0403)^t \end{gathered}](https://img.qammunity.org/2023/formulas/mathematics/college/wahiq3iqb72il6rlpg3kktumc2aoqyh4g4.png)

the rate is r=1.0403-1=0.0403=4.03%

In the 3.8% compounded quarterly

we have

r=3.8%=0.038

n=4

substitute

![\begin{gathered} A=P(1+(0.038)/(4))^(2t) \\ A=P(1.0095)^(2t) \\ A=P[(1.0095)^2]^t \\ A=P(1.0191)^t \end{gathered}](https://img.qammunity.org/2023/formulas/mathematics/college/d978u8za94xe147uk9ctz0cjeb9aacobtz.png)

the rate is r=1.0191-1=0.0191=1.91%

therefore

the 3.99% compounded semiannually is a better investment