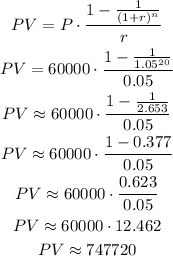

We have to calculate the present value PV of a annuity.

The payment is yearly and it is P=60,000.

The interest rate is 5% (r=0.05), compounded annually (m=1).

The number of periods is n=20 years.

Then, we can use the formula for the present value of a annuity:

Answer: the company must set aside $747,720.