We are to determine the amount that you have pay back after borrowing a principal amount ( P ) for ( t ) number of years which is compounded annualy at rate ( R ).

You borrowed a principal amount of:

The time duration for which we have borrowed the money for is:

The annual interest rate coumpounded each year is:

Step 1: Determine the simple interest that accumulated at the end of ( t ) years.

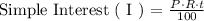

The folllowing formula is used to determine the simple interest that the borrower has to pay once the period of borrowing/lending is over i.e ( t ) years.

The simple interest is the proportional rate of interest ( R ) and the initial borrowed/loaned amount called principal amount ( P ).

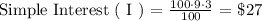

Use the above simple interest formula ( I ) by plugging in the respective values as follows:

Therefore, the total amount of interest that the borrower must pay as an extra ( over the borrowed amount ) is $27.

Step 2: Determine the total amount that is to be returned/paid to the lender

The total amoun that is to be paid by the borrower ( you ) to the lender is the principal amount borrowed ( P ) and the amount of interest accumulated for the contractual time period i.e ( I ).

Therefore, the amount that you need to pay altogether is: