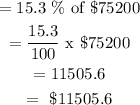

Step 1: Rodney Hampton earned $75,200 as a self-employed worker

% tax rate for self employed = 15.3%

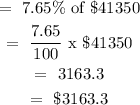

Step 2: Rodney Hampton earned $41,350 as a employee worker

%tax rate for employee = 7.65%

Step 3: FICA tax paid for both earnings = $11505.6 + $3163.3

= $14668.875

=$14668.88

Hence FICA tax paid for both earnings = $14668.88