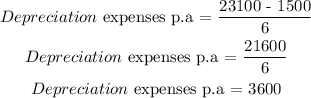

The company estimates a residual value of $1,500 and a six-year service life.

It is given that,

Cost of truck delivery = $ 23100

Salvage value = $ 1500

Useful life = 6 years

Depreciation expenses by using the straight-line method are calculated as,

Substituting the value in the formula,

Thu